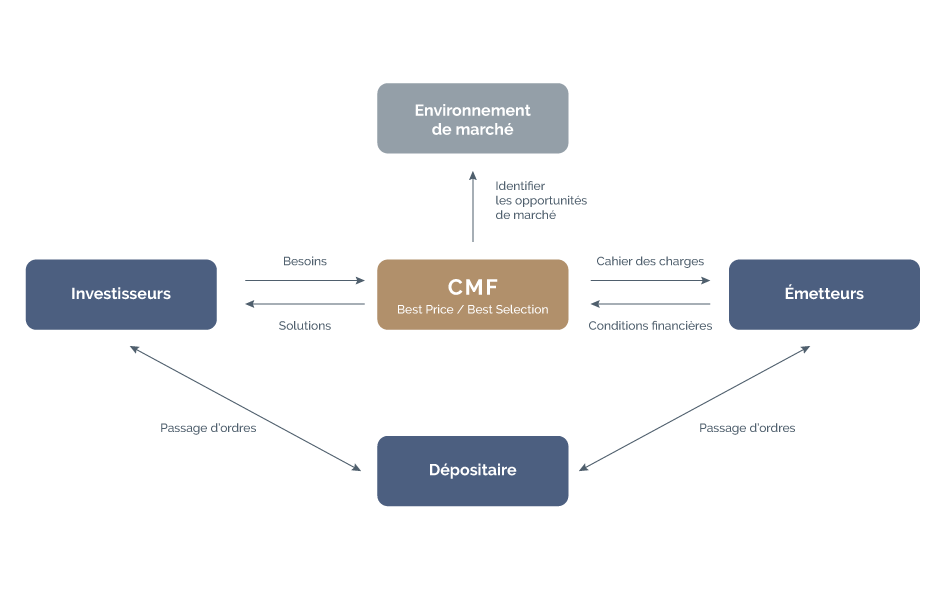

We design and provide access to innovative solutions tailored to a wide range of investors.

We work alongside them in selecting investment opportunities adapted to each investors and market conditions.

IFAs, fund managers, private bankers, family offices: we offer you innovative investment solutions and private portfolio management mandates.

Treasury managers, entrepreneurs: we provide cash flow solutions, supporting your short-, medium- and long-term liquidity needs.

Asset management companies, banks, insurance companies: we offer tailor-made solutions, while taking into account your regulatory constraints (Solvency II, ALM, etc.).

We’ve been working in open architecture with leading financial institutions for 15 years. Our proven expertise in financial markets and our privileged relationships with leading investment banks allows us to offer a comprehensive range of customized investment solutions. These dedicated solutions can be indexed to all asset classes (equities, fixed income, credit, commodities, etc.).

A key feature of our approach is educating and sharing knowledge about how structured products work and how they are built. We provide investors with support at every stage, to ensure that their needs are optimally managed.

An innovation halfway between asset management and tailor-made investment

An AMC is an actively managed certificate that encapsulates an investment strategy in a simple, flexible format.

All the parameters of an AMC can be customized according to the investor’s needs: investment universe (UCITS, structured products, equities, bonds, crypto), currency hedging, rebalancing, fee structure, etc.

AMC is an agile product, enabling allocation adjustment within the certificate and cost-effective centralized asset management.

Solutions to finance the real economy

Driven by innovation, we have naturally extended our range of solutions to include private debt, which has become increasingly popular in recent years. In addition to meeting major financing needs, it offers exposure to a wide range of economic sectors (real estate, transport, energy, etc.).

It also offers a number of advantages for sophisticated investors: diversification, a yield premium over traditional liquid assets and decorrelation. However, this type of investment carries risks inherent in its unlisted status. This type of investment is intended for experienced, sophisticated investors.

Access to investment funds distributed by CMF

Our network of partners and our experience give us access to exclusive management companies and experienced fund managers.

In tune with the market and our investors, we seek out and select relevant, differentiating strategies, with a constant and fundamental concern for market timing.

We apply our tailor-made approach to identifying and suggesting funds according to the objectives and needs of each investor.

Des produits d’assurance adaptés à vos objectifs

Le marché de l’assurance vie peut être complexe et difficile à naviguer sans une connaissance approfondie, nous pouvons vous fournir notre expertise pour trouver les solutions d’assurance les plus adaptés.

Parce que chaque individu a des besoins et des objectifs financiers uniques, nous pouvons vous fournir des recommandations personnalisées pour vous aider à atteindre ces objectifs.

FR